Global Feed Acidulants Market to Reach USD 6.36 Billion by 2034 at 5.66% CAGR, Led by Asia Pacific

Global feed acidulants market valued at USD 3.92 billion in 2025 is projected to reach USD 6.36 billion by 2034, growing at a CAGR of 5.66%.

The feed acidulants market is set to grow from USD 3.92 billion in 2025 to USD 6.36 billion by 2034, driven by antibiotic bans, rising demand for animal nutrition.”

PUNE, MAHARASHTRA, INDIA, February 8, 2026 /EINPresswire.com/ -- The global feed acidulants market size was valued at USD 3.92 billion in 2025 and is projected to grow from USD 4.09 billion in 2026 to USD 6.36 billion by 2034, exhibiting a CAGR of 5.66% during the forecast period. Asia Pacific dominated the global market with a share of 39.15% in 2025.— Fortune Business Insights

Feed acidulants are feed additives used in animal nutrition to regulate feed acidity and improve digestibility, nutrient absorption, and overall feed quality. These additives help enhance gut health, control microbial growth, and improve feed stability. As a result, they are widely incorporated into commercial feed formulations across poultry, swine, aquaculture, and ruminant production systems.

Get Free Sample PDF Here: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/feed-acidulants-market-114502

MARKET DYNAMICS:

MARKET DRIVERS:

Ban and Restrictions on Antibiotics Supporting Market Growth

The global feed acidulants market is gaining momentum due to restrictions on the use of antibiotic growth promoters (AGPs) in animal feed. The overuse of antibiotics has raised concerns regarding antimicrobial resistance, which can spread to humans through contaminated food, direct contact, or environmental pathways.

MARKET RESTRAINTS:

Raw Material Volatility and Production Challenges May Slow Market Growth

Manufacturing organic acidulants such as fumaric and lactic acids requires advanced fermentation technologies, making production capital-intensive. Fluctuations in the availability and pricing of raw materials such as sugar, corn, or natural gas can significantly impact production costs.

MARKET OPPORTUNITY:

Encapsulated Formulations Driving Product Innovation

Encapsulation technologies present a major opportunity in the feed acidulants market. Traditional acidulants degrade rapidly during feed processing or storage, reducing their efficacy. Encapsulation enables controlled release of active ingredients in the digestive tract, improving absorption and performance.

FEED ACIDULANTS MARKET TRENDS:

Shift Toward Sustainable and Bio-Based Production

A key trend in the feed acidulants market is the growing focus on bio-based and sustainable production methods. Feed manufacturers are increasingly sourcing organic acids derived from renewable resources to align with ESG goals and sustainable supply chain practices.

Segmentation Analysis:

By Type:

Organic Acidulants Lead Market Due to Effectiveness in Gut Health

The market is segmented into organic acidulants and blended acidulants. The organic segment includes propionic acid, formic acid, lactic acid, citric acid, acetic acid, benzoic acid, and others.

The organic acidulants segment accounted for the largest market share of 92.94% in 2026.

By Form:

Dry/Powder Form Dominates Due to Storage and Cost Advantages

Based on form, the market is segmented into dry/powder and liquid.

The dry/powder segment accounted for the largest share of 64.82% in 2026. This form minimizes spillage risks, reduces equipment corrosion, and simplifies storage and transportation. Improved shelf stability further supports its dominance.

The liquid segment is expected to grow at a CAGR of 5.10% during the forecast period, owing to its ease of mixing and uniform feed acidification.

By Source:

Synthetic Acidulants Lead Due to Cost Efficiency and Scalability

Based on source, the market is divided into synthetic and natural acidulants.

The synthetic segment accounted for the largest market share of 67.03% in 2026. Large-scale industrial production enables economies of scale, ensuring cost efficiency, high purity, and consistent quality.

The natural segment is projected to grow at a CAGR of 5.71%, supported by increasing demand for non-GMO, eco-friendly, and clean-label feed ingredients.

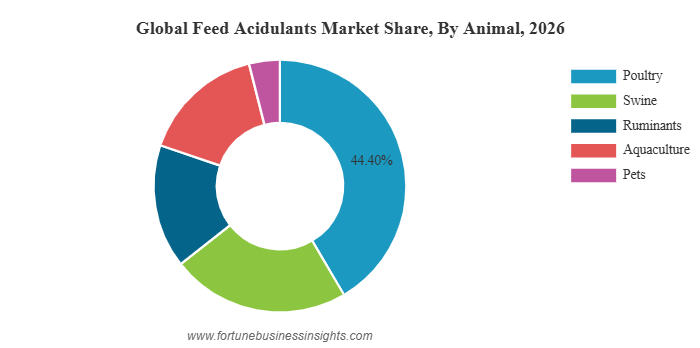

By Animal:

Poultry Segment Leads Due to High Demand for Antibiotic-Free Products

The market is segmented into poultry, swine, ruminants, aquaculture, and pets.

The poultry segment held the largest share of 44.40% in 2026, driven by global demand for poultry meat and eggs. Feed acidulants improve growth rates, feed intake, and production uniformity in poultry systems.

The swine segment is projected to grow at a CAGR of 5.25%, as acidulants help improve feed utilization, weight gain, and gut health, particularly during the post-weaning stage.

Feed Acidulants Market Regional Outlook:

Asia Pacific

Asia Pacific dominated the global market with a valuation of USD 1.53 billion in 2025. The region is one of the largest producers and consumers of animal protein, driving strong demand for feed additives.

China, India, and Japan are key markets adopting feed acidulants to enhance animal health and optimize feed efficiency.

South America

South America is expected to witness strong growth, reaching USD 1.13 billion in 2025. Major meat-exporting countries such as Brazil and Argentina are increasingly adopting acidulants to comply with international food safety standards.

Europe

Europe is projected to reach USD 0.60 billion by 2025, making it the second-largest regional market. Strict regulations, including Regulation (EC) No. 1831/2003, restrict antibiotic growth promoters and promote organic acid-based feed additives.

North America

The North American market is estimated at USD 0.24 billion in 2025. Large feed manufacturers and regulatory frameworks such as the Veterinary Feed Directive

Speak with Analysts here: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/feed-acidulants-market-114502

LIST OF KEY FEED ACIDULANTS COMPANIES PROFILED:

BASF SE

Yara International ASA

Eastman Chemical Company

Koninklijke DSM N.V.

Corbion N.V.

Perstorp Holding

Kemin Industries, Inc.

Peterlabs Holdings Berhad

Nutrex N.V.

Tate & Lyle PLC

KEY INDUSTRY DEVELOPMENTS:

August 2025: RD LifeSciences launched SPEC-7O, a feed additive supporting health and performance across multiple animal species.

October 2024: Phibro Animal Health acquired a medicated feed additive portfolio from Zoetis Inc., expanding its capabilities.

April 2021: Eastman Chemical acquired 3F Feed & Food (Spain) for USD 70 million, strengthening its organic acid derivatives portfolio.

February 2019: ADM acquired Neovia for USD 1.73 billion, expanding its global animal nutrition business.

REPORT COVERAGE:

The global feed acidulants market report provides detailed qualitative and quantitative insights, including market size, growth forecasts, segmentation, regional analysis, and competitive landscape. It examines key drivers, restraints, opportunities, and trends, along with recent industry developments, mergers, acquisitions, and regulatory influences shaping the market.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.